Hourly to take home calculator

No api key found. Simply enter their federal and state W-4 information as well as their.

Paycheck Calculator Take Home Pay Calculator

The payroll calculator from ADP is easy-to-use and FREE.

. Take home pay 656k. Monthly take-home salary Annual salary12 64240012 53533. For instance according to 2022 figures Berlin has the lowest median salary 42224 and take-home pay 27878 resulting in an effective tax rate of 34.

See where that hard-earned money goes - Federal Income Tax Social Security and. A Hourly wage is the value specified by the user within GP. Your salary - Superannuation is paid additionally by employer.

Important Note on Calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Then multiply that number by the total number of weeks in a year 52.

The city-state is followed closely. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above.

When you make a pre-tax contribution to your. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52. It can also be used to help fill.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. In the Weekly hours field. B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Use this simple powerful tool whether your.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. - In case the pay rate is hourly.

It is perfect for small business especially those new to payroll processing. Total yearly take-home salary Gross salary Total deductions 7 lakhs 48600 642400.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Salary Calculator

Annual Income Calculator Factory Sale 51 Off Www Ingeniovirtual Com

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

How To Calculate Payroll For Hourly Employees Sling

Hourly To Salary Calculator

Hourly Rate Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

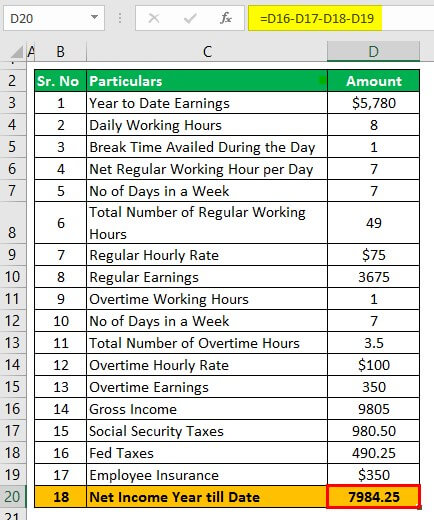

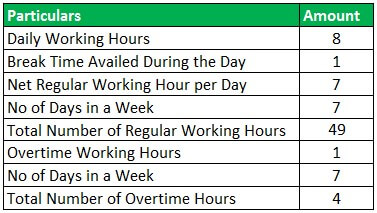

Hourly Paycheck Calculator Step By Step With Examples

Adp Salary Paycheck Calculator Shop 55 Off Www Ingeniovirtual Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Step By Step With Examples

Calculators Annual Salary Calculator Billable Hours Head Hour Rate

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow

Paycheck Calculator Take Home Pay Calculator

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com